It’s my birthday on Saturday and — in honor of turning 51 — I’m running a flash sale offering more than $200 off my signature course, Pricing Right: Price Your Career Services with Confidence!

Through midnight Central on my birthday (9/21), if you are one of the first 51 people to take advantage of this flash sale, you will get the FULL COURSE for just $51 (that’s 80% off the regular price of $259!).

The course is designed to help anyone who struggles with pricing their services — from new resume writers to veterans.

The “Pricing Right” course is nine lessons, and each lesson is an average of 15 minutes long. You can work your way through the lessons at your own schedule (it’s self-paced).

When you complete the course, you’ll have a CONCRETE basis for setting your prices (new clients & returning projects), strategies for communicating your pricing (including how to handle push-back on your pricing as well as how to communicate price increases), and you’ll be able to avoid the most common mistakes in pricing your career industry services. There’s also a special lesson on raising your prices — critical these days as our cost of doing business continues to increase!

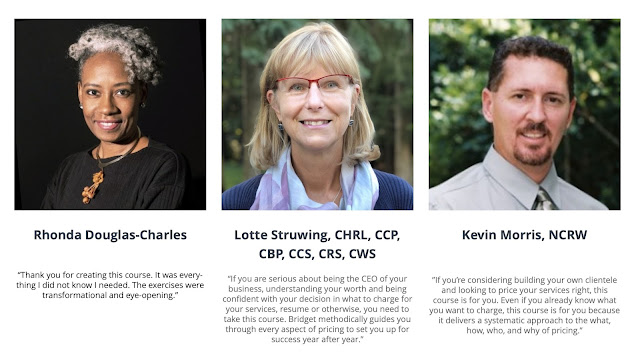

Here’s what colleagues have to say about the course:

But don’t wait to enroll. There are only 51 enrollments available during this special flash sale. Enroll now.

You can watch a preview of the course here:

If you’ve ever struggled with pricing your career services (and let’s be honest … we all have!), this course is for you. Get the practical, actionable information you need to set your prices so you can hit your revenue goals the final three months of 2024.

Remember, this sale price is only available until midnight Saturday – and only for the first 51 career industry colleagues who sign up. Enroll here!